Basic Life and AD&D Insurance - Company Paid

Having appropriate life insurance coverage is a critical part of planning for your family’s current and future financial needs. Proceeds from life insurance can help with salary replacement, mortgage

protection, cost of childcare, debt repayment and children’s education expenses.

Your amount of life insurance is an amount equal to 2 times your Annual Earnings plus $25,000, but in no event more than $275,000. Your amount of life insurance will be rounded to the next higher multiple of $1,000. Your amount of accidental death and dismemberment (AD&D) insurance is equal to Your amount of life insurance. Basic Life and AD&D insurance is administered by Mutual of Omaha and is paid for by the Cooperative of American Physicians. You are automatically enrolled in these benefits.

Voluntary Life and AD&D Insurance

The premiums for this insurance are paid in full by you.

While the Cooperative of American Physicians offers basic life insurance, some employees may want to purchase additional coverage. Think about your personal circumstances. Are you the sole provider for your household? What other expenses do you expect in the future (for example, college tuition for your child)? Depending on your needs, you may want to consider buying supplemental coverage.

Why Do I Need Life Insurance?

Ask yourself this: In the event of my death, how would my family …

- Pay final expenses?

- Pay off debt?

- Pay for daily living expenses (housing, food, bills, etc.)?

- Replace Your Income?

- Maintain financial stability?

Watch: Life and AD&D Insurance

Watch: Term Life Insurance

Common Life Insurance Terms

- Accidental Death Insurance (AD&D): Generally an add-on to a regular life insurance policy, it is only paid if the death of the insured occurs as the result of an accident.

- Age Reductions: Most insurance policies reduce your life insurance benefit as you age.

- Beneficiary: The person or party named by the owner of a life insurance policy to receive the policy benefit.

- Contingent Beneficiary: The party designated to receive proceeds of a life insurance policy following the insured’s death if the primary beneficiary predeceased the insured.

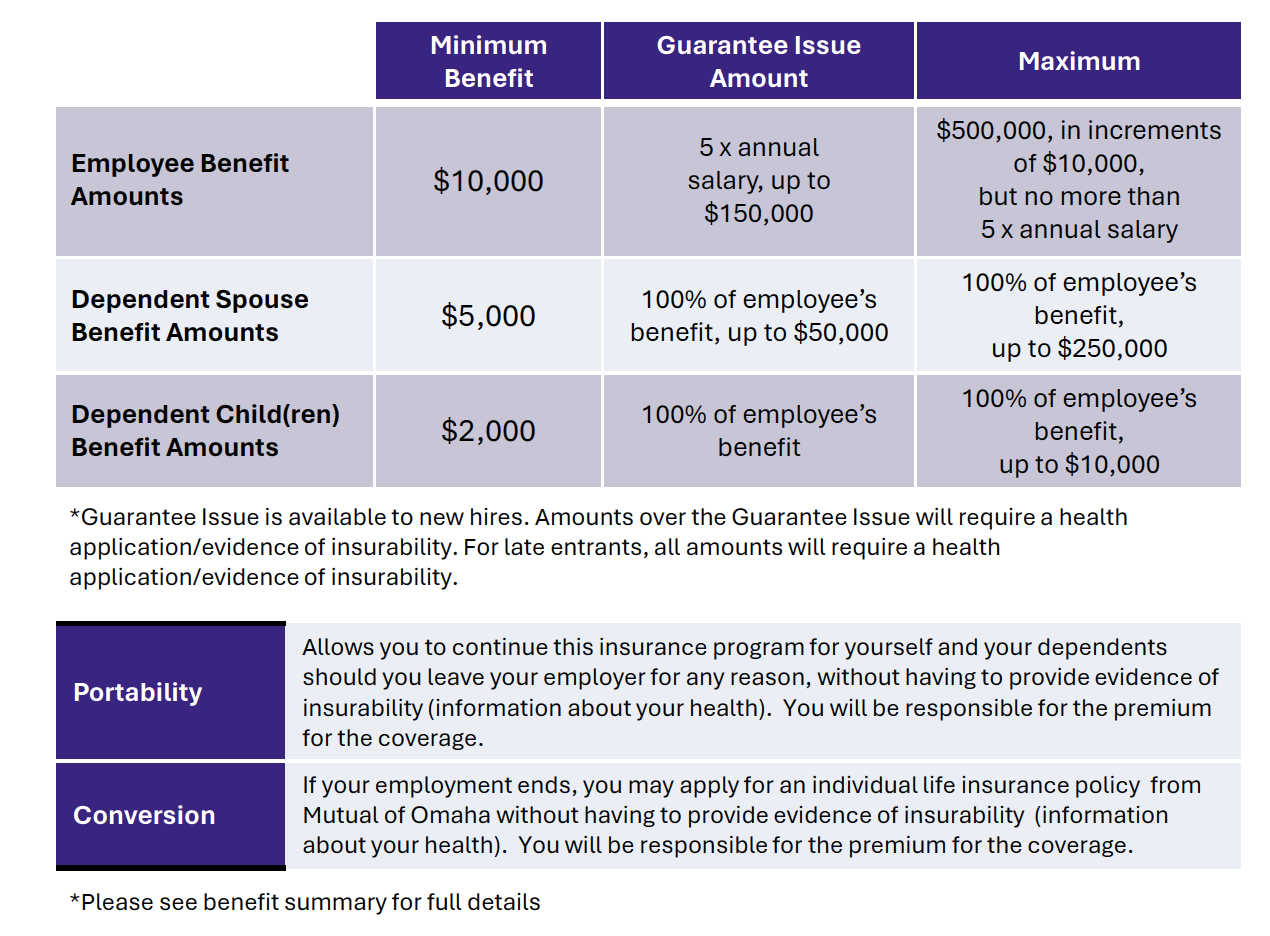

- Conversion: If you ever leave employment, you may be able to convert the group policy into an individually owned life insurance policy.

- Coverage Amount: Value of life insurance.

- Portable: If you ever leave employment, you may be able to port the life insurance coverage to a new plan.

- Premiums: Amount paid to the insurance company to buy a policy and keep it in force.