Which Medical Plan is Right?

You have a choice of medical plan options to help you and your family take charge of your health care and find the right fit. These plans have different copayments, coinsurance, deductibles, and out-of-pocket limits.

Evaluate Your Needs. Consider your prior health care usage and select plans and options that fit your lifestyle and needs.

· Do you take regular prescription medications?

· Are you anticipating surgery or non-preventive dental care?

· Did you experience a qualifying life event this year?

· Review your current plans to ensure you have the coverage you need.

Review this benefits website to learn about your new and existing plan options.

A little bit of planning will help you select the best plans, coverage levels, and financial programs for your unique situation.

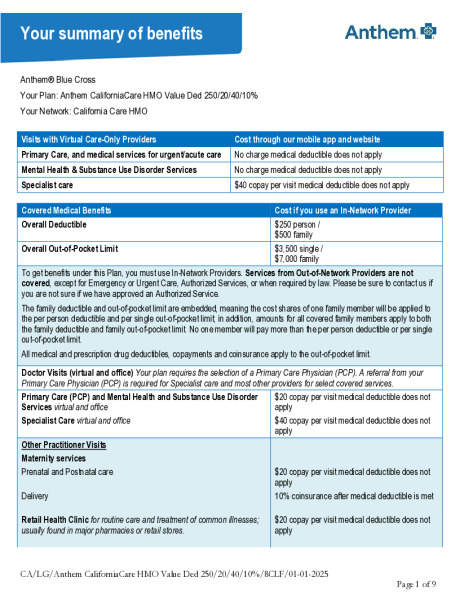

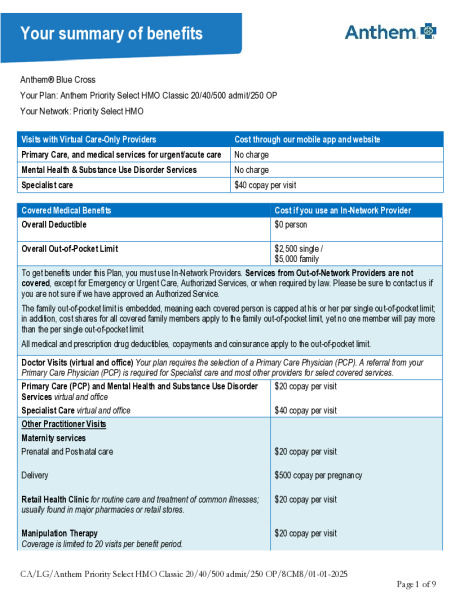

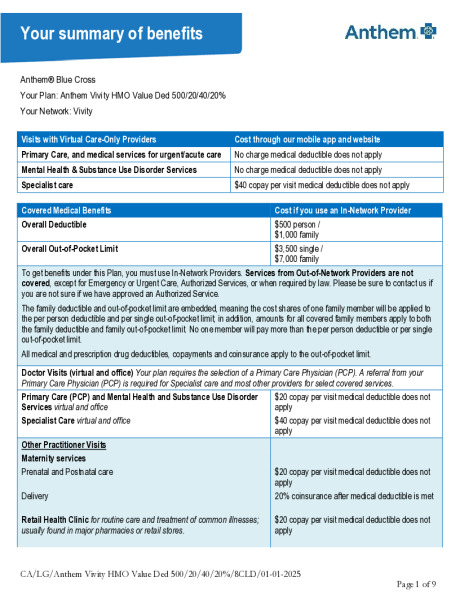

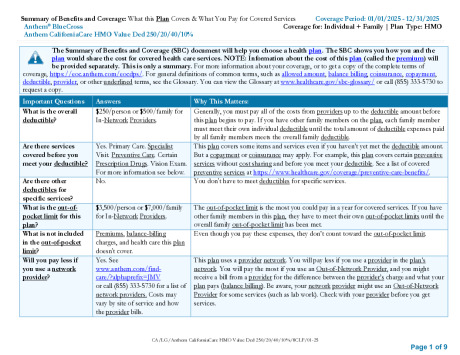

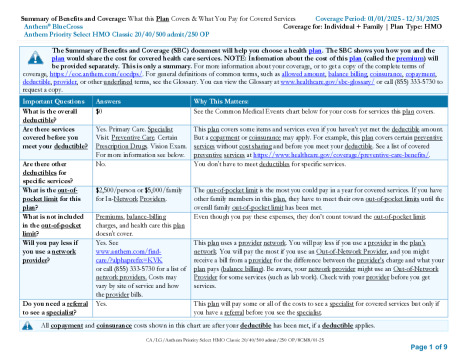

Medical Plan Comparison - HMO

| California Care HMO Value Deductible | Priority Select HMO Classic | Vivity HMO Value Deductible | ||||

|---|---|---|---|---|---|---|

| Annual Medical Deductible (calendar year) | ||||||

| (Individual/Family) | $250 / $500 | None | $500/$1,000 | |||

| Annual Out-of-Pocket Limit (calendar year) | ||||||

| (Individual / Family) | $3,500 / $7,000 | $2,500/$5,000 | $3,500/$7,000 | |||

| Office Visit | ||||||

| Annual Preventative Visit | $0 | $0 | $0 | |||

| Primary Care Physician | $20 | $20 | $20 | |||

| Specialist | $40 | $40 | $40 | |||

| Urgent Care (Within Area*) | $20 | $20 | $20 | |||

| Virtual Care Services*** | $0 | $0 | $0 | |||

| Diagnostic Services | ||||||

| Routine Lab & X-Ray | $0 | $0 | $0 | |||

| Complex Imaging | $125 | $125 | $125 | |||

| Hospital Services | ||||||

| Inpatient Stays | 10% Coinsurance** | $500 Per Admission | 20% coinsurance** | |||

| Outpatient Surgery | 10% Coinsurance** | $250 | 20% coinsurance** | |||

| Emergency Room (Waived if admitted) | $200 and 10% Coinsurance** | $200 | $200 and 20% Coinsurance** | |||

| Ambulance | $150 | $150 | $150 | |||

| Mental Health and Substance Abuse | ||||||

| Inpatient | 10% Coinsurance** | $500 Copay | 20% coinsurance** | |||

| Outpatient | $0 | $20 | $20 | |||

| Chiropractic Services | ||||||

| 20 Visits Per Year | $20 | $20 | $20 | |||

*Urgent care services provided within the geographic area served by your medical group. Please consult your physician website or office for available urgent care facilities within the area served by your medical group.

**After deductible has been met.

***Benefits are available only when services are delivered through a Designated Virtual Network Provider. You can find a Designated Virtual Visit Network Provider by contacting Anthem at www.anthem.com or by calling the number on the back on your ID card.

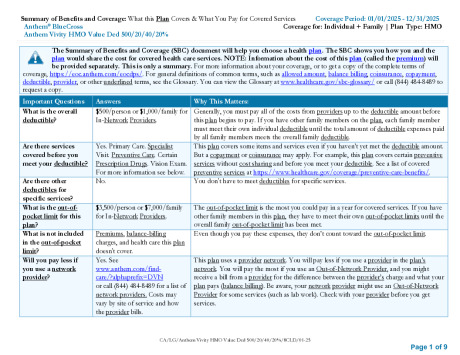

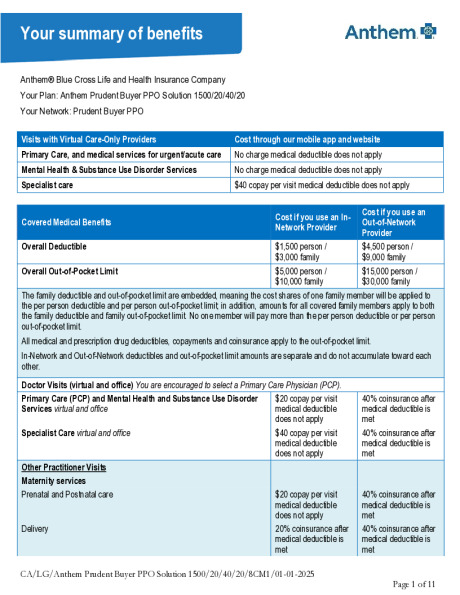

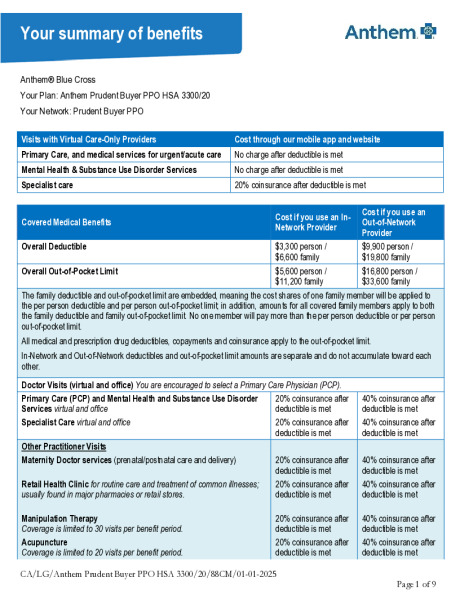

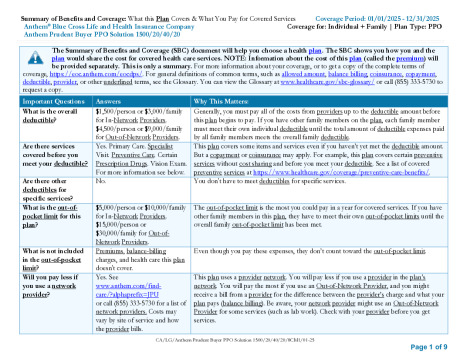

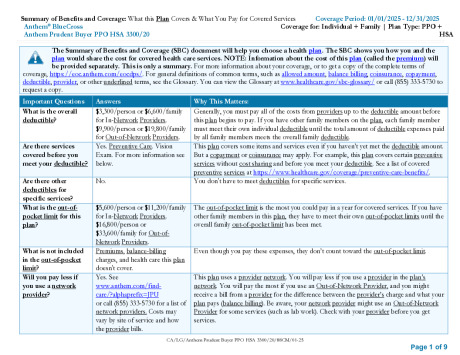

Medical Plan Comparison - PPO

| Prudent Buyer PPO 1500 | Prudent Buyer PPO HSA | |||

|---|---|---|---|---|

| Annual Medical Deductible (calendar year) | ||||

| (Individual/Family) | $1,500/$3,000 | $3,300/$6,600 | ||

| Coinsurance | 20% | 20% | ||

| Annual Out-of-Pocket Limit (calendar year) | ||||

| (Individual / Family) | $5,000/$10,000 | $5,000/$11,200 | ||

| Office Visit | ||||

| Annual Preventative Visit | $0 | $0 | ||

| Primary Care Physician | $20 | 20% after deductible | ||

| Specialist | $40 | 20% after deductible | ||

| Urgent Care | $20 | 20% after deductible | ||

| Virtual Care Services* | $0 | 20% after deductible | ||

| Diagnostic Services | ||||

| Routine Lab & X-Ray1 | 20% after deductible | 20% after deductible | ||

| Complex Imaging 1 | 20% after deductible | 20% after deductible | ||

| Hospital Services | ||||

| Inpatient Stays 1 | 20% after deductible | 20% after deductible | ||

| Outpatient Surgery1 | 20% after deductible | 20% after deductible | ||

| Emergency Room (copay waived if admitted) | $150 copay and then 20% after deductible | 20% after deductible | ||

| Mental Health and Substance Abuse | ||||

| Inpatient1 | 20% after deductible | 20% after deductible | ||

| Outpatient1 | $20 Copay | 20% after deductible | ||

| Chiropractic Services | ||||

| 30 Visits Per Year | $40 Copay | 20% after deductible | ||

Benefits shown are assuming in-network providers are utilized

1Prior Authorization Required

*Benefits are available only when services are delivered through a Designated Virtual Network Provider. You can find a Designated Virtual Visit Network Provider by contacting Anthem at www.anthem.com or by calling the number on the back on your ID card.