Voluntary Benefits

Accident, Critical Illness, and Hospital Indemnity coverage are available to you, your spouse, and your dependent children. However, employees must have coverage in order for their spouse and children to obtain coverage.

Voluntary Benefits are just that, voluntary. The costs for voluntary benefits are 100% paid by the employee. You can get a custom quote from the respective providers.

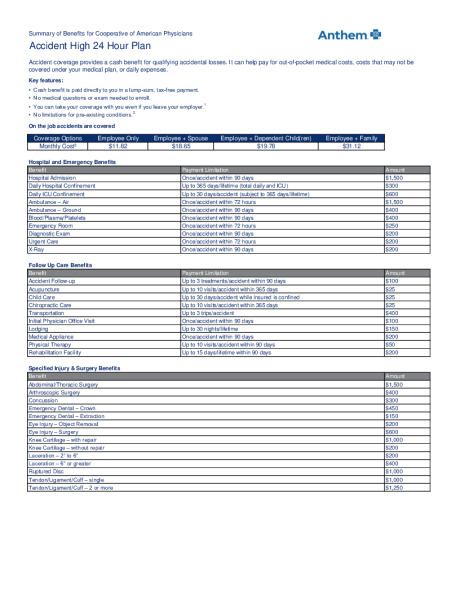

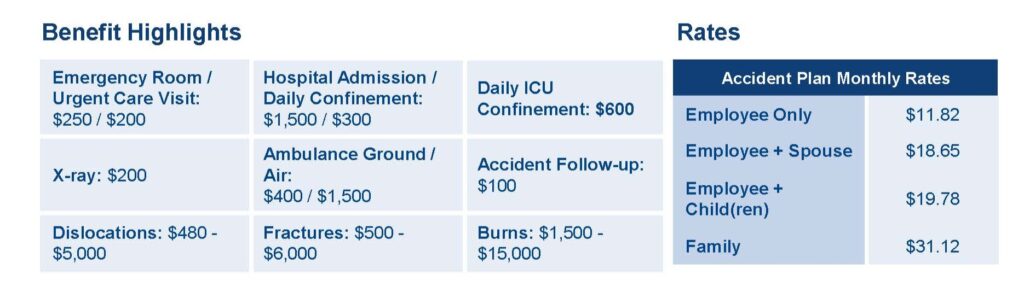

Voluntary Accident Insurance

The Anthem Accident Plan pays you if you are injured in an accident to help offset medical costs and lost income during your recovery. You may add coverage for yourself and your dependents, even if not enrolled in a medical plan with CAP. Please see the benefit summary for detailed benefits information.

Watch: Accident Insurance

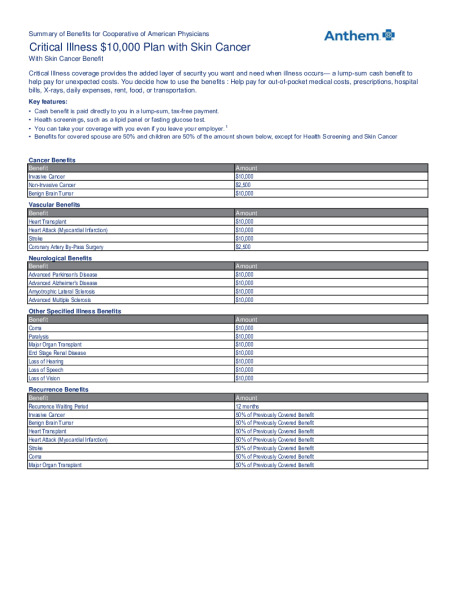

Voluntary Critical Illness Insurance

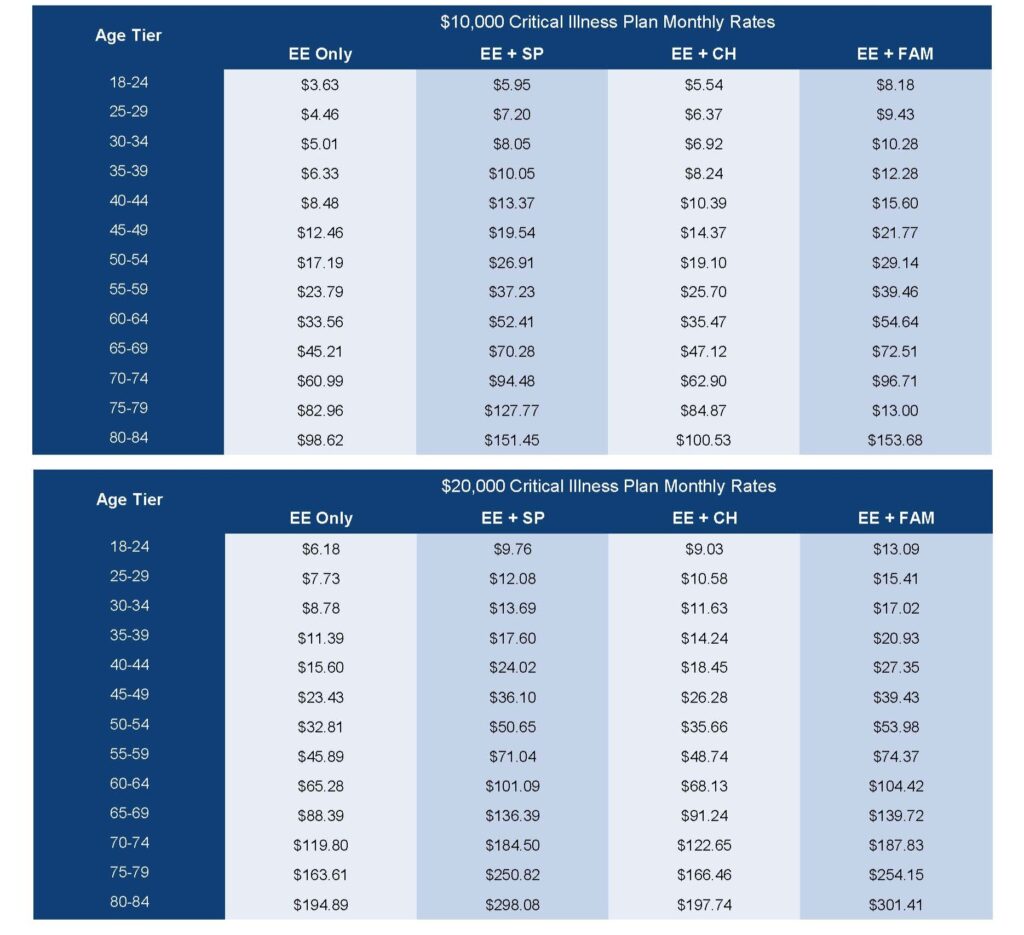

Critical Illness coverage provides the added layer of security you want and need when illness occurs— a lump-sum cash benefit to help pay for unexpected costs. You decide how to use the benefits. Critical Illness coverage provides benefits for heart attack, stroke, invasive cancer, major organ transplant, and neurological conditions such as advanced Alzheimer’s and advanced Parkinson’s. The coverage pays for the first diagnosis of certain illnesses after your coverage becomes effective. This plan even covers skin cancer. The employee benefit amount is $20,000, and for spouses and children is $10,000.

Watch: Critical Illness Insurance

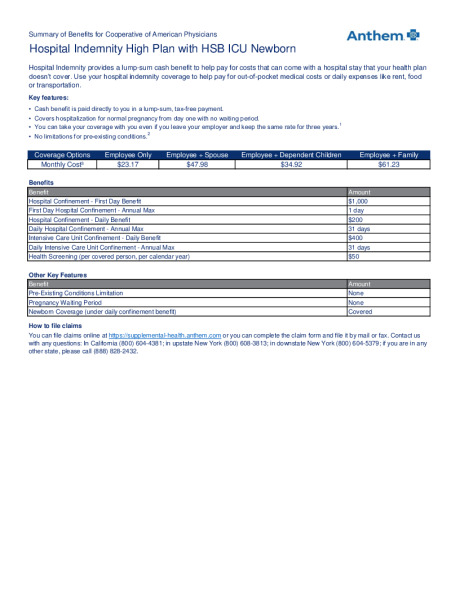

Voluntary Hospital Indemnity Insurance

If you experienced a medical emergency, would you be prepared to cover the out-of-pocket medical expenses? And, what about everything else that adds up—like bills, groceries, and housing?

Major medical insurance plans are designed to pay a large portion of your medical costs. But with a high deductible health plan, you must pay out of your own pocket until you meet your deductible and plan maximum.

That’s where Limited Benefit Hospital Indemnity Insurance can help.

Watch: Hospital Indemnity Coverage

MetLife Pre-Paid Legal, ID Theft, and Pet Insurance

MetLife Pre-Paid Legal

- A cost-effective plan providing access to more than 18,000+ experienced network attorneys.

- Unlimited use of network attorneys for covered issues.

- Assistance for a wide range of legal needs, including money matters, home and real estate, family and personal matters, civil lawsuits, elder care issues, and vehicles and driving.

- Online digital estate planning tool—create wills and trusts, healthcare proxies, and power of attorney documents from the comfort of home.

Rates: $16.75 per month

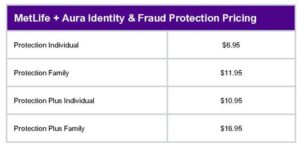

MetLife + Aura ID Theft & Fraud Protection

We’re doing more online than ever before – making us more vulnerable to fraud and online threats. MetLife and Aura Identity & Fraud Protection helps safeguard the things that matter to you most: your identity, money and assets, family, reputation, and privacy.

Questions?

Aura’s customer service team is available 24/7/365.

Call 1-844-931-2872

MetLife Pet Insurance

What’s covered?

- accidental injuries

- illnesses

- exam fees

- surgeries

- medications

- ultrasounds

- hospital stays

- X-rays and diagnostic tests

- hip dysplasia

- hereditary conditions

- congenital conditions

- chronic conditions

- alternative therapies

- holistic care

- and much more!

To get a quote or enroll go to

www.metlife.com/getpetquote

or call 1 800 GET-MET8.